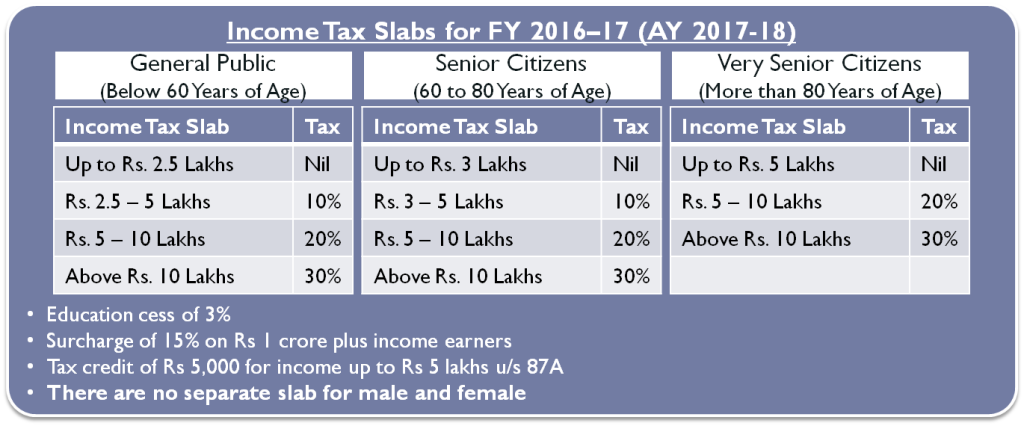

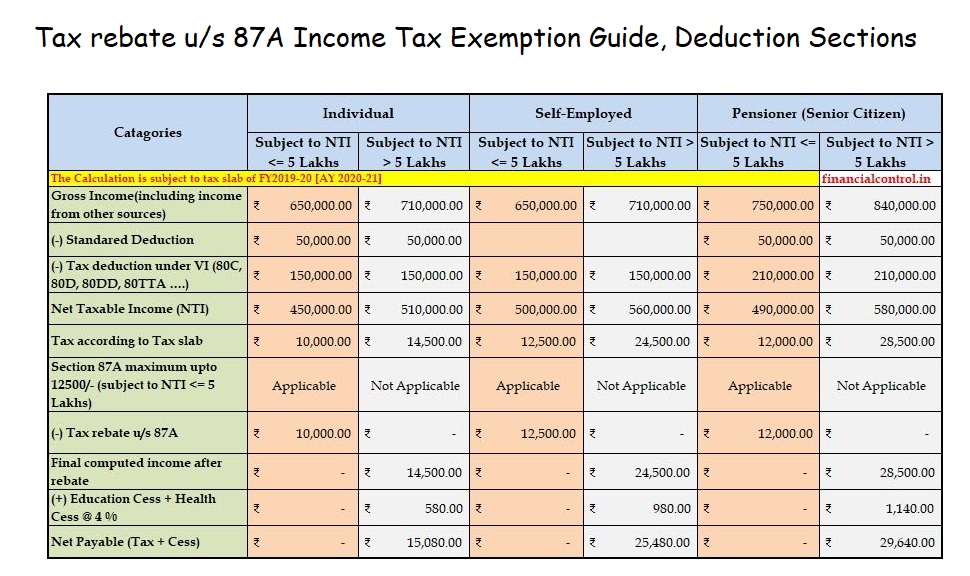

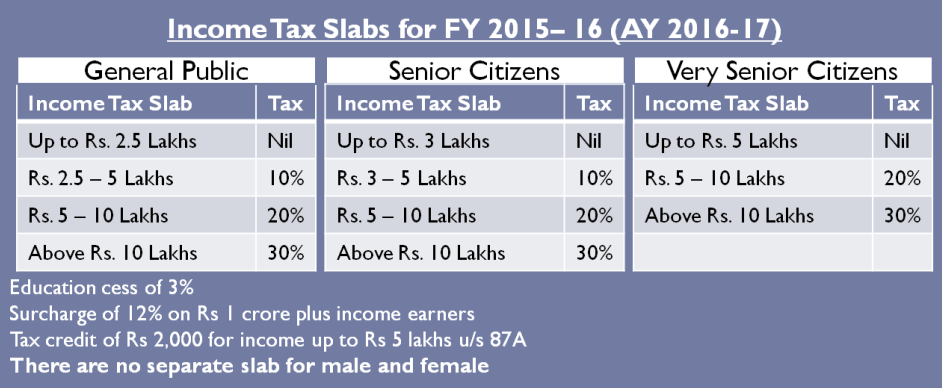

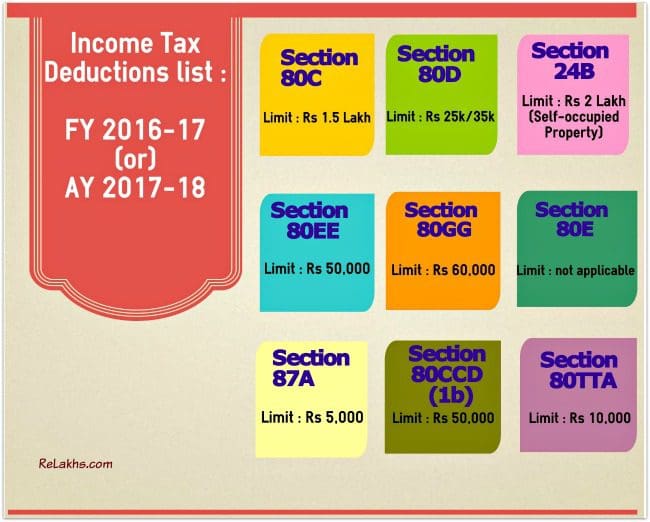

Section 87A Rebate Limit Increased to Rs. 5000 – Budget 2016, With All in One TDS on Salary for W.B.Govt employees for F.Y.2016-17 – tdstaxindia.net

Tax Rebate raised up to Rs.5,000/-U/s 87A of the Income Tax Act 1961,with Automatic All in one TDS on Salary for Central & State Employees for F.Y.2016-17 – tdstaxindia.net